Entering the Canadian Market: Advantages and risks that companies should be aware of

Volkswagen, Roche, Rio Tinto, Cellcentric, Siemens Energy, Google and Amazon. Aside from being internationally recognized companies, one major theme that they all have in common is a recent investment to establish or expand operations in Canada. Over the last few years, businesses small and large from a wide range of fields including advanced manufacturing, power generation and tech, have announced plans to grow across Canada. To better understand what makes it such an attractive place for businesses, DTO B2B Research & Strategies outlines the top macro-economic opportunities and risks to consider when thinking about entering the Canadian market.

Stable Economy

Many countries have faced financial struggles over the last few years as a result of numerous global events including Covid-19, the war on Ukraine and a rising cost of living. While Canada has also faced these challenges, it has managed to place within the top 5 countries for largest economic growth amongst the G7 (Canada, France, Germany, Italy, Japan, UK, USA) and within the top 15 largest economies in the world. In 2023, Canada ranked as the world’s 9th largest economy by Gross Domestic Product (GDP). The Canadian economy has proven its resilience even through difficult times. This is true of recent years, but also when looking to the past. The 2008 global financial crisis, which saw bank failures, bailouts and severe recession in some countries was considered less severe in Canada. At the time, the Canadian banking system was highly praised for its ability to successfully withstand such a significant recession compared to counterparts in US, UK and Europe (though critics argue it is this conservative nature which also prevents accelerated growth). The resilience and stability of the Canadian economy is a major reason that Canada is a top choice for emerging and expanding businesses alike. A stable economy, with a consistent employment rate means that businesses can rely on relatively consistent operational activities and costs as well as access to a steady consumer population in both challenging and prosperous times.

Highly Skilled Workforce

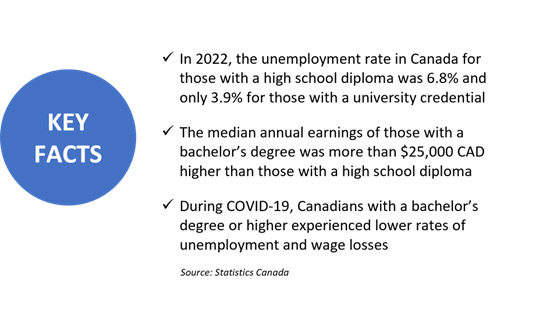

Canada is the leader amongst G7 countries for educational attainment with 57.5% of working-aged Canadians holding a postsecondary credential and 32.9% holding a bachelor’s degree or higher—a number which continues to rise. While Canadians hold credentials from a wide range of subject areas, the largest number of recent graduates from Canadian institutions are coming from business, social sciences, and health programs. From an economic perspective, there are many benefits to having a highly educated population. Unemployment rates for those with a postsecondary credential are consistently lower than for those without. Having higher educational attainment is also likely to result in a higher income. Finally, education can also increase job security, even during difficult economic periods.

At the individual-level, higher levels of stable employment and higher wages enable greater financial security and positive health outcomes for workers, their families, and their future generations. Looking at the bigger picture, countries with a highly educated population can encourage economic growth. In short, businesses can really benefit from a highly educated population like Canada’s. They can access a competitive talent pool of highly qualified workers and at the same time, can anticipate a relatively stable customer base with disposable income. Although high wages can also be a drawback for some businesses, the Canadian workforce is increasingly being considered as an attractive alternative, partly due to a competitive talent pool with lower wage expectations in key fields. For example, the median salaries of American tech employees are roughly 40% higher than that of Canadian tech employees. Beyond education, Canada’s population is once again a leader in another important area—growth. From 2016 to 2021, Canada had the fastest growing population amongst G7 countries. In fact, during this time, Canada’s population growth rate (5.2%) was nearly 2x higher than the second and third fastest of the G7 (UK at 2.9% and US at 2.6%) and more than 10x faster than the EU overall (0.5%). Nearly 60% of Canada’s recent immigrants were admitted under the economic category, which selects immigrants for their ability to contribute to the Canadian economy. For businesses in the Canadian market, this means that the highly qualified talent pool is likely to continue getting larger. It also means that the local consumer base will continue to grow. More than just these immediate effects, the rapid population growth of well-educated and employed people has broader positive ramifications on the economy, including greater stability, growth and spending potential.

International Opportunities

Although a strong local market is important for business, having a large number of global trade agreements enables greater access to a broader customer base, as well as other potential partnerships such as suppliers. Canada has 15 free-trade agreements with 49 different countries—granting simplified access to 1.5 billion potential customers and business partnerships worldwide. Beyond trade agreements, Canada has a number of other advantages when it comes to doing business internationally. With significant land, air and sea access points, businesses that desire a strong global presence can benefit from the Canadian market. While English and French are both official languages of Canada, most Canadians speak English, which can be advantageous for companies and industries where English is the language of business. There are a wide range of languages spoken in Canada. Many speak French and 18% of Canadians are bilingual in English and French. Mandarin, Punjabi and Cantonese are some of the most commonly spoken foreign languages in Canada. Due to its diverse immigration background there are more than 200 other languages spoken in Canada. This means that Canadian employees are often well suited to working in international environments, but also has the added benefit of multilingual support for foreign companies and investors entering the Canadian market with many banks, companies and at times government organizations offering support in an array of key foreign languages.

Business Growth Policies

In recent years, the Canadian government, at all levels, has been ramping up efforts to encourage business growth and increased investment in both Canadian-grown and international businesses. Canada’s base corporate tax rate is competitive, and a number of different tax incentives are available to help support business development. Businesses can also receive varying levels of tax credits for clean technologies, manufacturing, and electricity generation. A wide variety of other government-led or supported investments aimed at elevating businesses in targeted sectors and groups exist. Provincial and territorial governments have also been offering support to encourage business growth in Canada. For example, in Ontario (Canada’s most populous province) ‘Open for Business’ has been used as the government’s key slogan to define policies aimed at growing the economy and creating jobs within the province. Red tape reduction policies and targeted tools such as events, workshops, guides and hiring incentives were also made available. Businesses in the Canadian market can benefit from the pro-business policy efforts and funding opportunities that are available. While they can be tricky to navigate—often being targeted towards specific industries, sectors or groups, the wide range of existing and future opportunities could be advantageous.

Potential Risk: Financial Pressures

So far, the points considered have largely cast a positive light on entering the Canadian market. However, like with any other market, there are some risks which need to be evaluated. Canada is still facing challenges resulting from recent global events. Inflation remains higher than targeted, the cost of living has increased and there is a predicted 1.4% decline in real GDP growth in 2023. Despite these setbacks, there are also positive indicators that must be considered. Inflation has fallen from peak levels; the unemployment rate is reverting to near-record lows and Canada’s strong commodity export economy has experienced revenue growth even during high-inflation. For businesses, since the economy can still reasonably be expected to remain stable, entering the market now could be seen as an opportunity to enter at the ground-level.

Potential Risk: Internal Trade Barriers

While there are not federally or provincially/territorially imposed tariffs on goods and services traded within Canada, there various internal barriers that impede internal trade and labour mobility within the country. For businesses operating in the Canadian market, especially where operations, purchasing or sales are carried out between different jurisdictions, these barriers can pose a significant challenge and result in unnecessary costs and effort. The federal, provincial, and territorial governments of Canada recognize these barriers. In 2017, The Canadian Free Trade Agreement (CFTA) came into force to reduce and eliminate barriers to the free movement of people, goods, services, and investments within Canada and to establish an open efficient, and stable domestic market. So, while the barriers continue to be a challenge, work is being carried out to improve internal trade and business moving forward. The extent to which these barriers impact a business depends entirely on the business itself. For example, businesses that operate solely in a single province or territory are not likely to find this barrier prohibitive to their business.

Potential Risk: Value of the Canadian Dollar

Because the United States is Canada’s largest trade partner, the Canadian dollar is most often compared against the US dollar as a means to gauge its value. While the value of the Canadian dollar can vary (especially in relation to commodity prices), it has typically been lower than the US dollar, reaching parity or holding slightly more value than the US dollar for relatively short periods on a small number of occasions. Today, July 13, 2023, $1 CAD (a loonie) is worth $0.76 USD or €0.68. For businesses operating in the Canadian market, this means that buying power for imported goods and services is weaker. At the same time, export-based businesses may find the lower value makes their business more profitable. The value of the dollar, whether positive or negative, can affect a wide range of businesses including retail, tourism and hospitality in completely different ways. Depending on where the majority of costs are incurred, and where the majority of profits are made, the lower value dollar can be a weakness or an opportunity.

What does this mean for your investment?

Ultimately, there are plenty of interesting opportunities and calculated risks to consider when thinking about entering or expanding within the Canadian market. DTO B2B Research & Strategies provides clients with customized solutions to fit their exact needs. Our highly qualified team has extensive expertise across a wide range of industries including B2B research, machinery, logistics, cleaning, and energy with offices in North America, Europe, and Asia.

Have questions about market strategies in Canada, North America or beyond? Get in touch with us to discuss how DTO’s team of experts can support your business strategy.

Text written by Stephanie Kaldas