“Should I Stay or Should I Go?”

Jörg Wuttke on China’s Manufacturing Future

DTO had the honor of listening to Jörg Wuttke, former Vice President of BASF China and long-time President of the EU Chamber of Commerce in China, speak on insights into the country’s evolving political economy.

His remarks were particularly relevant for industrial and manufacturing leaders to think about how to position themselves in the Chinese market.

From Reform to Re-Ideologization

Wuttke described how the optimism of Deng Xiaoping’s reform era, which opened China to global markets and competition, has shifted under Xi Jinping toward political tightening and ideological resurgence.

He cited Document No. 9 (2013) as the pivotal point: curbing “Western values,” reducing cooperation with foreign institutions, and strengthening ideological control across media, academia and civil society.

For manufacturers, this signals a policy environment that is more politically driven and less predictable, especially for foreign firms operating in strategic industries.

Self-Reliance as Strategy

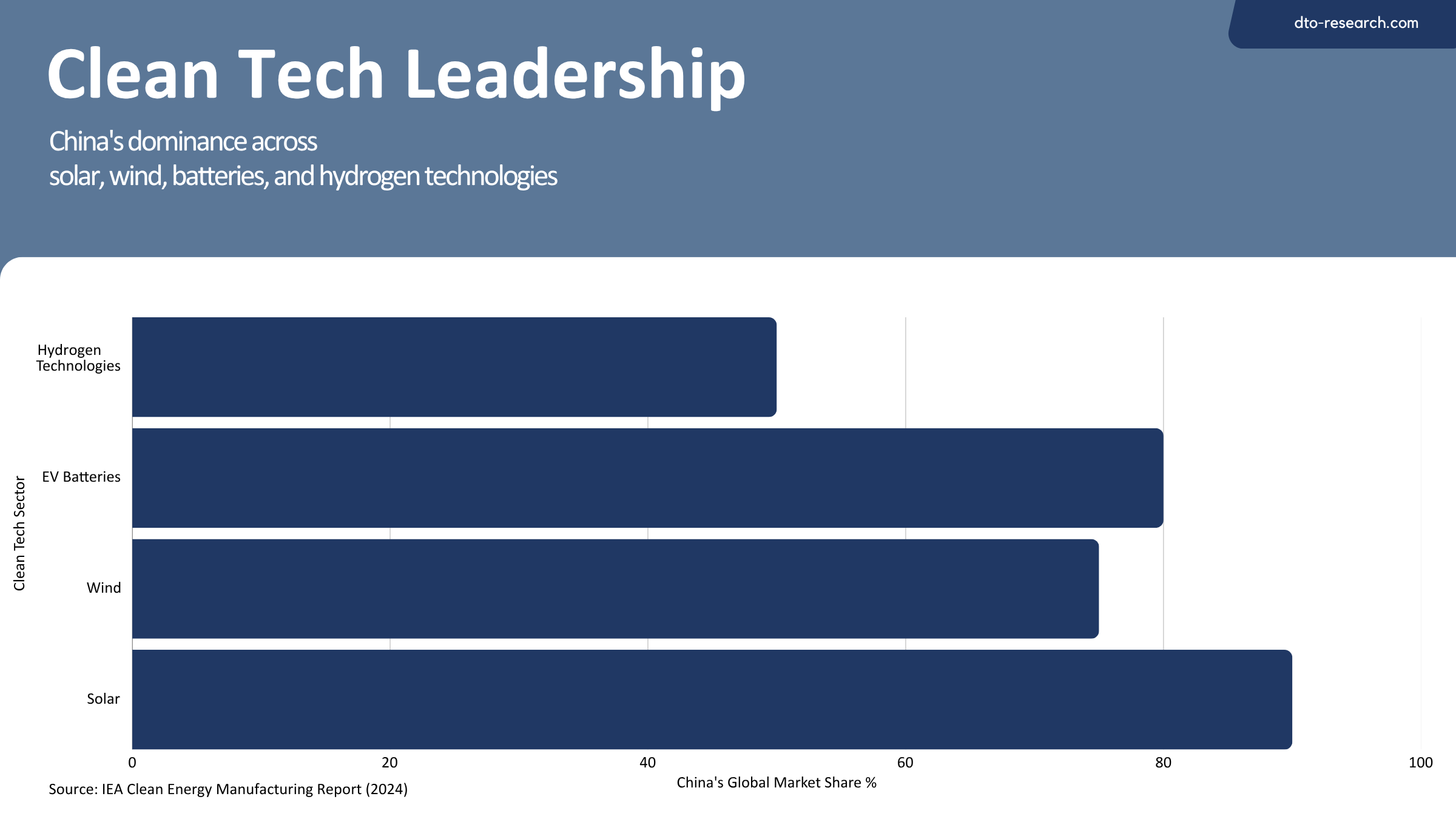

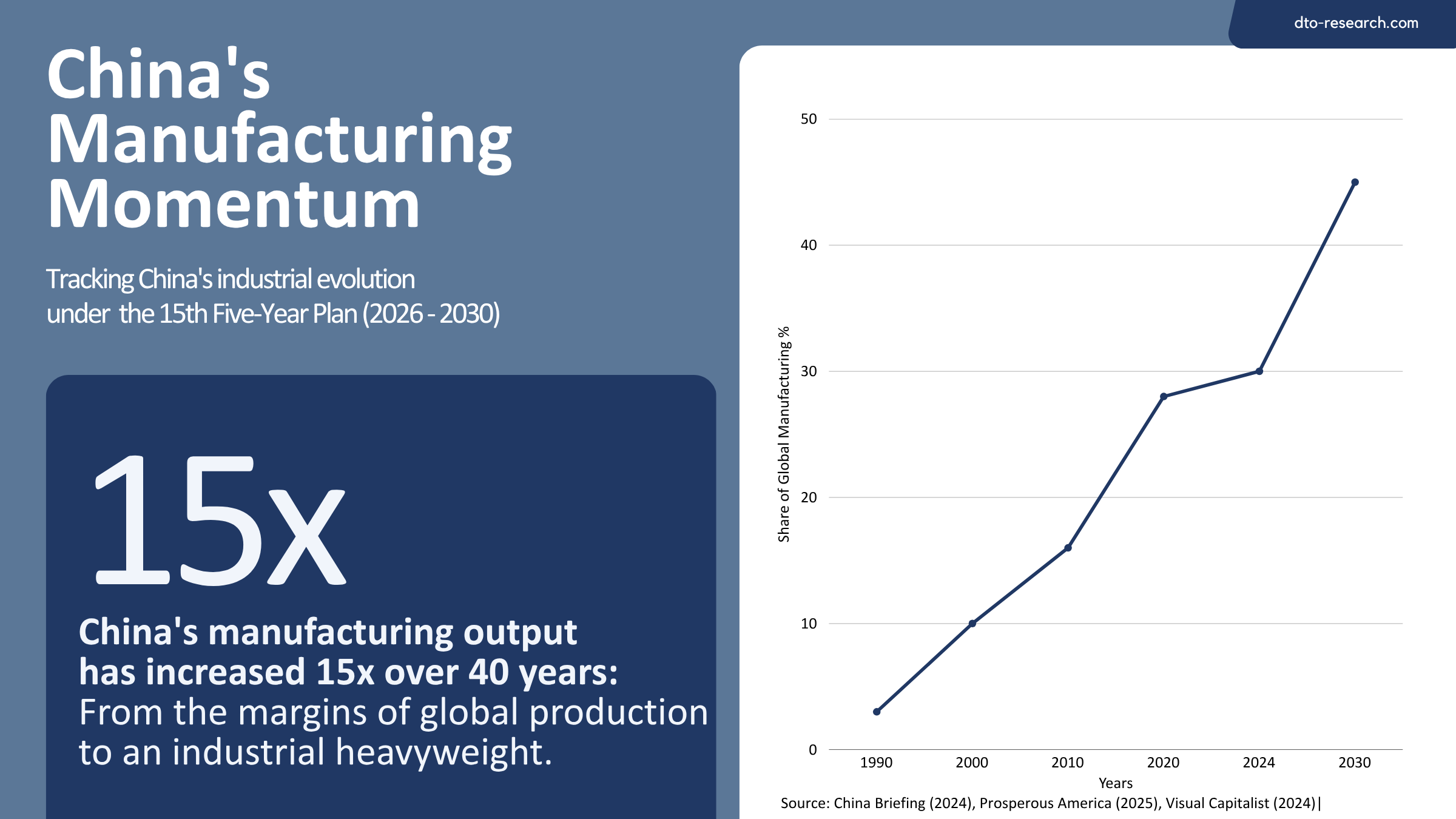

Beijing’s call for “self-reliance” is not isolationist - it is expansionist. Wuttke observed that previous Five-Year Plans drove domestic dominance in batteries, EVs, semiconductors, solar and wind power, creating overcapacity by design.

“Whatever China plans, it ends up overbuilding.”

The new 15th Five-Year Plan (2026–2030) continues that model, targeting AI, robotics, semiconductors, biomanufacturing, and green technologies as key growth pillars. China already accounts for about 30% of global manufacturing, and both Wuttke and independent analysts project this could rise toward 40 – 45% by 2030.

For foreign manufacturers, the takeaway is twofold:

1. Opportunity to partner in high-tech growth sectors.

2. Risk of being out-scaled by state-backed domestic champions.

Manufacturing Barometer: Export and Capacity Push

Wuttke pointed out that this new drive will again rely on exports to absorb overcapacity. He mentioned that China ordered over 100 roll-on/roll-off car-carrier ships within four years, expanding vehicle export capacity by roughly one million units per year.

The strategy, he said, is clear: China plans to produce more - and sell more - abroad.

China as the “Fitness Center” for Global Industry

Despite these challenges, Wuttke described China as a “fitness center” for global firms. German automakers, chemical producers, and technology companies continue investing there not only for market access, but because the scale and speed of the Chinese market force innovation and operational agility.

Demographics and Decline

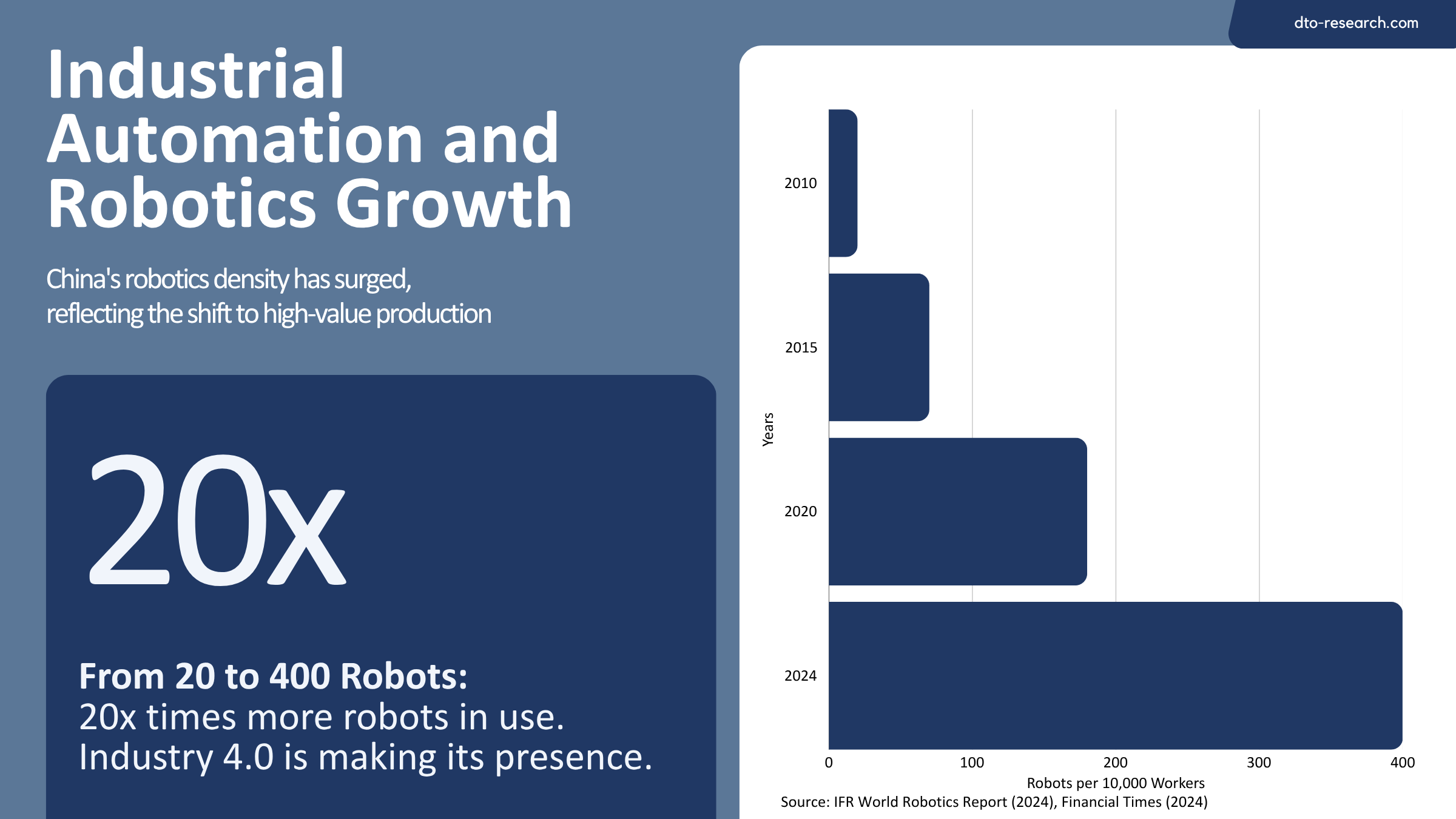

Behind the industrial momentum lies a looming headwind: demographics.

China will age faster than any other major economy:

- older than the U.S. by 2030

- older than the E.U. by 2046

- older than Japan by 2064

Some demographers estimate that China’s real population may already be 100 million lower than reported, accelerating labour shortages and wage pressures.

This makes automation and robotics critical to sustaining manufacturing output: fittingly reflected in the new plan’s focus.

For Manufacturers: Questions to Re-Evaluate Strategy

- Is your presence in China built for scale, or for innovation and resilience?

- How exposed is your supply chain if China expands to 40%+ of global manufacturing?

- Can your firm benefit from China’s automation and clean-tech boom without over-reliance on its ecosystem?

- What diversification or regional manufacturing strategies could strengthen resilience (e.g., Southeast Asia, India, Mexico)?

Conclusion

Wuttke’s talk underscored a core reality:

Manufacturing in and from China is no longer just about cost and capacity, it’s about strategy, technology, and positioning within a shifting global system.