You Can’t Afford to Ignore Politics

There is a reason why populism and income inequality have been on the Davos agenda for years even though clearly nothing much has come out of it: both issues present material risks - both in the short and long- term. Look around and you’ll see this is true. It is not just economic activity that is reawakening. COVID-19 has exposed (and worsened) cracks in systems everywhere. Protests are exploding in the United States while Hong Kong is in deep trouble.

It is clear that we can no longer afford to treat politics as “just politics” - or something outside a business’s profit and loss calculation. If you want resilience, thinking of business as something separate from the fabric of society is a losing proposition. These are times to think deeply about what sort of society we want to be a part of, and then act with intent to be part of creating that society. Each and every one of our choices matter.

The status quo needs to go.

Prior to the 20th century, companies were intertwined with society. Adam Smith saw "no contradiction between The Wealth of Nations (about markets) and The Theory of Moral Sentiments (about moral philosophy)." But in came the shareholder capitalism narrative, which prioritized profits and dividends over all else. Inequality boomed and executive pay skyrocketed, while resentment simmered among the masses. And now, when hit with an unpleasant aspect of capitalism, many raise their hands and say, “Oh well, that's the free market economy.” That’s a cop-out that prevents us from tackling tough problems. A true free market economy gives each individual agency to decide what and where to invest - or not and includes taking ethical, moral and social positions. It is time to end the idea of shareholder primacy and re-open the doors to Smith's original vision about what capitalism should be.

The great reawakening calls for bold action.

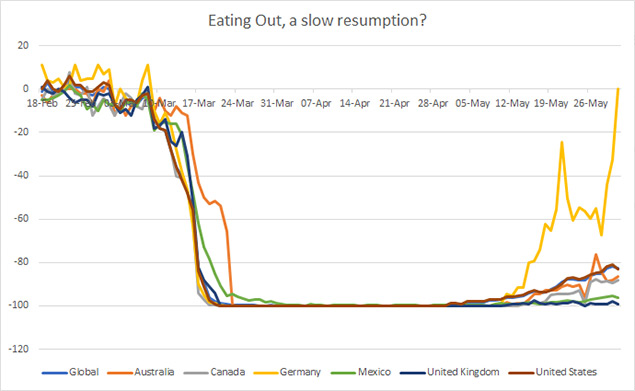

Life is returning to normal, sort of. People are gradually starting to fly, go back to work, and eat out. Long-running tensions are also reawakening. It is not easy to know, however, whether this is a turning point or just another passing moment, especially as bottled-up anger over long standing problems and dysfunctions are laid bare, and systemic injustices boils over, as for example in the United States. Still, once-in-a-lifetime opportunities exist for governments, society, and businesses to make bold changes - both economically and socially. Failing to do so might only make things worse, especially as so many remaining at the edge of socioeconomic desperation, which is sure to sow the seeds for an even more violent convulsion down the road. As economies re-open around the world, pent up pre-COVID frustrations can boil over sparked by post-COVID realities. Leaders, policymakers and society need to be prepared to roll up their sleeves and do more than just tweet and 'like'.

COVID silver lining - direct cash transfers.

People now have money in their bank and digital accounts thanks to governments direct transfers in both the developed and developing world. Countries should be doing more of this to support their citizens and SMEs to improve social resilience. Letting "big companies drink deep from the hose of central bank liquidity, while their smaller counterparts fight over the trickles to survive" is simply unsustainable; SMEs form the bulk of economic activity, taxes, and employment. While people may not spend the added income while uncertainty continues, at some point these transfers will be re-invested into economies through surges in pent-up demand. Remember that cash transfers may seem like a new normal, but this is a watershed moment, it will shape how governments respond to crisis for decades to come.

Something that's not decoupled - Demand and trade.

Yes, there's lots of talk of de-globalization, localization and the Asian century where Asia is decoupled from the rest of the world. It is true that data supports part of this narrative, but only part. China, which has been at center of global and Asia's supply chains is consuming more at home as are some other emerging and frontier Asian markets. But, and this is a big one, North American and European demand for stuff made in Asia still matters, yes even for China. A bulk of trade is still in parts and components that get assembled in Asia and then sent back to where consumers buy them. Even if supply chains relocate, the ultimate driver of demand still matters. With all this talk of decoupling, it is worthwhile remembering how interdependent we all are in more ways than one.